Commercial property finance is a broad and often misunderstood landscape. It’s not a single product or borrower type, it ranges from a dentist purchasing their clinic to a developer financing a multi-unit scheme, or a landlord refinancing a mixed-use asset to release capital.

This guide cuts through the noise to help you understand how commercial mortgages work, the types of finance available, how lenders assess applications, and how to structure finance that aligns with your long-term goals.

What Is a Commercial Mortgage?

A commercial mortgage is a loan secured against property used partly or wholly for business or investment purposes. These loans are generally not regulated by the Financial Conduct Authority (FCA), unless more than 40% of the property is for residential use.

Common Uses:

- Purchase or refinance trading premises

- Acquire income-generating commercial assets

- Fund developments or significant refurbishments

- Release equity for expansion or liquidity

Types of Commercial Lending

| Category | What It Covers |

|---|---|

| True Commercial | Offices, retail, industrial units, warehousing, leisure premises |

| Commercial Investment | Landlords acquiring or refinancing tenanted commercial properties |

| Residential Portfolio Finance | Portfolio landlords using SPVs or LLPs to hold BTL, HMO, and block assets |

| Bridging Finance | Short-term loans for acquisitions, auctions, refurbishments, or planning gains |

| Mezzanine Finance | Secondary layer of debt to increase leverage behind senior development funding |

| Development Finance | Ground-up construction, conversions, or heavy refurbishment projects |

In-Depth: Key Commercial Lending Types

True Commercial Mortgage

- Purpose: Buy or refinance wholly commercial property.

- Typical Assets: Offices, clinics, retail units, warehouses, restaurants.

- Borrowers: Commercial landlords, trusts, SPVs.

- Key Factors: Tenant covenant, lease length, ICR (Interest Coverage Ratio), location.

Owner-Occupier Commercial Mortgage

- Purpose: Acquire premises for trading businesses.

- Examples: Solicitors’ offices, GP surgeries, manufacturing warehouses.

- Borrowers: Trading businesses, professionals, LLPs/Ltd companies.

- Key Factors: Affordability based on trading performance, not rent; often higher LTVs allowed.

Commercial Investment Mortgage

- Purpose: Fund income-generating commercial property.

- Assets: Tenanted retail units, mixed-use blocks, industrial parks.

- Borrowers: Landlords, investors, trusts.

- Key Factors: Yield-based valuation, lease security, void risk. Interest-only terms may apply.

Residential Portfolio Finance

- Purpose: Consolidated funding across multiple residential units (e.g. BTLs, HMOs).

- Borrowers: Portfolio landlords via SPVs or LLPs.

- Key Factors: Portfolio-wide analysis, interest coverage, cross-collateralisation options.

Bridging Finance

- Purpose: Fast, short-term finance for auctions, refurbishments, or pre-planning acquisitions.

- Borrowers: Developers, traders, investors needing speed.

- Key Factors: Exit strategy is crucial. Interest typically rolled up. Higher rates reflect risk.

Mezzanine Finance

- Purpose: Boost leverage when senior loan falls short.

- Borrowers: Developers and sponsors with strong exit routes.

- Key Factors: Second charge or profit participation, higher risk and interest, senior lender consent.

Development Finance

- Purpose: Fund new builds, conversions, or heavy refurbishments.

- Borrowers: Developers, housebuilders, contractors, JVs.

- Key Factors: Drawn in tranches, based on LTC (Loan to Cost) and LTGDV (Loan to Gross Development Value). Requires planning, cost schedules, and exit plan.

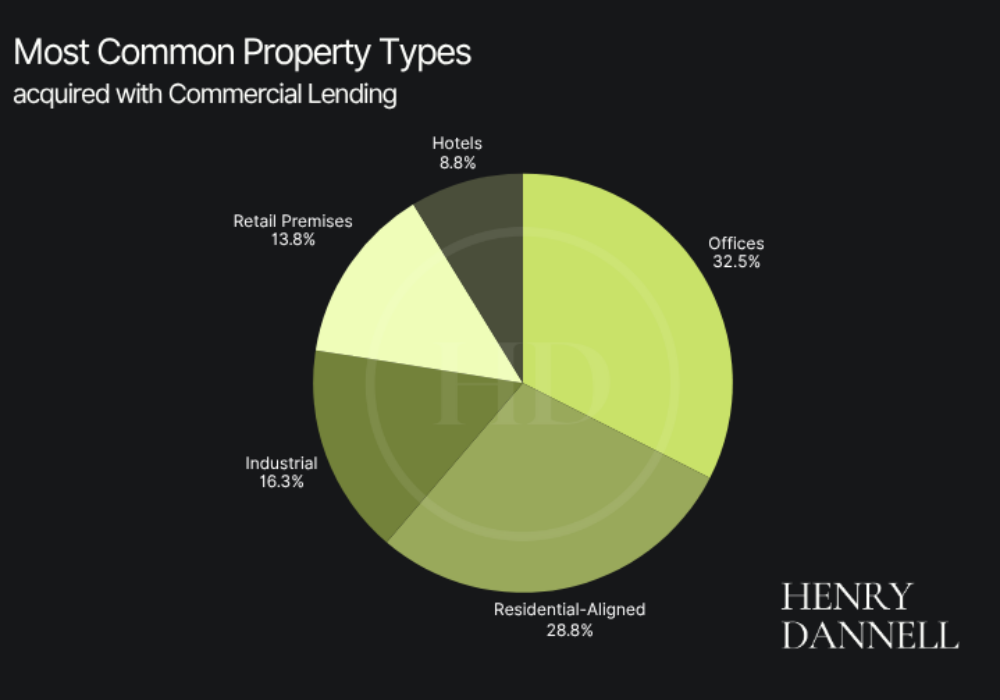

Market Snapshot: Commercial Lending Sector Breakdown

Who Uses Commercial Mortgages?

- SMEs: Securing long-term stability by acquiring premises (e.g. dental surgeries, vet clinics).

- Landlords: Expanding commercial or residential property portfolios.

- Developers: Funding land, new builds, conversions, and refurbishments.

- SPVs / LLPs: Ring-fencing liabilities or optimising tax treatment.

- Trusts: Managing family wealth and succession planning.

- Trading Businesses: Releasing equity from existing premises to support growth.

Common Use Cases for Commercial Mortgages

Buying Business Premises

E.g. a GP purchasing their clinic, assessed on profitability and future outlook.

Refinancing to Release Capital

Equity extraction to fund acquisitions or reduce debt.

Acquiring Investment Assets

Buying tenanted retail or industrial property using yield-based lending.

Development Projects

Ground-up builds or conversions, funded in tranches linked to construction progress.

Short-Term Bridging Loans

For time-sensitive deals where fast execution is critical.

Mixed-Use Properties

Lending is apportioned between residential and commercial elements (e.g. shop with flats above).

How Commercial Mortgage Lenders Assess Eligibility

Term Commercial Mortgages (Owner-Occupier & Investment Loans)

Term lending is designed for borrowers seeking long-term stability. Lenders focus on income sustainability and asset security over time.

Key Eligibility Criteria:

Property Type & Sector

Demand in the local market, use class (e.g. B1, D1, E), tenant strength (if investment), and asset condition.

Loan-to-Value (LTV)

Typically 65–75% for standard commercial property. May be lower for niche sectors.

Serviceability

Investment Loans: Rental income assessed against interest coverage ratios (ICR).

Owner-Occupier Loans: Business profitability and cash flow reviewed across 2–3 years.

Stress testing for rate rises is often applied.

Borrower Structure

Individuals, Limited Companies, SPVs, LLPs, or Trusts. Each may affect tax treatment, underwriting approach, and lender availability.

Experience

Especially relevant for portfolio landlords or businesses with multiple locations. Trading history adds confidence.

Sector Appetite

Some lenders avoid retail or hospitalityogistics. Matching the asset to lender appetite is crucial.

Short-Term Commercial Mortgages (Bridging & Development Finance)

Short-term finance is more focused on security and certainty of repayment. The lender is less concerned with long-term income and more focused on the exit.

Key Eligibility Criteria:

Property Type & Strategy

Assets under refurbishment, land with or without planning, or buildings requiring change of use. Lender appetite varies depending on stage and asset class.

Loan-to-Value / LTC / LTGDV

Bridging: Up to 75% of current market value, higher in exceptional circumstances

Development: Typically 65–75% of build cost (LTC), and 55–65% of end value (LTGDV).

Exit Strategy

The single most important factor. Must be credible and time-bound:

- Sale of asset (contract in place or planned)

- Refinance (term lender agreed or lined up)

- Staged repayment (unit sales or equity injection)

Serviceability

Generally not required unless the loan is serviced monthly. Most interest is rolled up or retained, especially for bridging or development projects.

Borrower Profile & Experience

Lenders favour experienced developers or those from the sector

Strong track record, relevant project history, and familiarity with planning/build costs all reduce perceived risk.

Planning & Permissions (for Development Finance)

Full planning permission is typically required. Lenders will also review build schedules, QS reports, and contractor credentials.

Commercial Mortgage Rates, Terms & Fees

Short-Term Lending (Bridging & Development Finance)

| Feature | Typical Range/Detail |

|---|---|

| Loan Term | 3 to 24 months |

| Interest Rate | 0.7% to 2.5% per month |

| Repayment | Rolled-up, retained or monthly serviced |

| Arrangement Fee | 1-2% of the loan amount |

| Exit Fee | 0-2%, if applicable |

| Valuation Costs | Higher for distressed or unbuilt properties |

| Monitoring Surveyor | Often required (cost linked to project size) |

| Legal Fees | Both parties’ costs covered by borrower |

Note: Short-term funding prioritises speed and exit clarity. Higher rates reflect increased risk.

Long-Term Commercial Mortgages (Owner-Occupier or Investment)

| Feature | Typical Range/Detail |

|---|---|

| Loan Term | 3 to 25 years |

| Interest Rate | From 2.5% above base rate for prime borrowers |

| Repayment | Capital and interest or interest-only (if viable) |

| Arrangement Fee | 1-2% of the loan |

| ERCs | Often apply during fixed-rate periods |

| Valuation Costs | Higher than residential; varies by asset type |

| Legal Fees | Both parties’ costs apply |

Note: Long-term lenders focus on sustainable income and stability. Approval takes longer and involves more documentation.

Risks & Considerations

Benefits

- Releases tied-up capital

- Enables growth through acquisitions or development

- Interest may be tax-deductible (seek professional advice)

- Fixed rates offer long-term certainty

Risks

- Rates higher than residential equivalents

- Personal guarantees are often required

- Refinancing or sales can take time

- Missed payments risk repossession

Exit Strategy: A Non-Negotiable for Commercial Mortgage Lenders

Lenders don’t just want to know why you’re borrowing, they want to know how you’ll repay.

Development: Will you sell or refinance completed units?

Bridging: Is a long-term lender already lined up?

Investment: Does the asset yield enough to justify term borrowing?

A clear, credible exit equals stronger lender confidence and better pricing.

Sustainability of Income: Why It Matters To Commercial Mortgage Lenders

For term mortgages and investment loans, lenders must be confident the income is durable:

- Commercial investments: Secure leases, strong tenants, low void risk.

- Owner-occupiers: Profitable trading history, resilient business model.

- Residential portfolios: Solid yield, geographic and tenancy diversification.

Why Use a Commercial Mortgage Broker?

- Access to lenders not visible to the public

- Tailored structuring of your case to align with lending appetites

- Full lifecycle support,from submission to drawdown

- Stronger terms through market knowledge and leverage

- Protects against missteps that delay or derail funding

Common Questions

Is it hard to get a commercial mortgage?

Not if your case is well-packaged. Lender match and presentation are everything.

Do I need a broker?

Many lenders work exclusively via brokers. A good broker unlocks access, improves pricing, and reduces friction.

Are commercial mortgages regulated?

Most are not. But if more than 40% of the property is residential, the loan may fall under FCA regulation.

If you’re considering your next move, speak with a commercial mortgage broker at Henry Dannell. We’ll help structure a solution that anticipates your future, not just funds the present.

Risk warning: A mortgage is secured against your property. Your property may be repossessed if you do not keep up repayments on your mortgage or any other debt secured on it. Lending is subject to status and individual circumstances.