For first-time buyers (FTBs), staying informed about upcoming changes in the property market is essential to avoid unexpected costs. With the March 31st stamp duty deadline fast approaching, now is the time to understand what’s changing and how it may impact your home purchase.

What’s Changing?

Since September 2022, first-time buyers have benefited from a stamp duty exemption on homes priced up to £425,000, helping to reduce upfront costs and make homeownership more accessible.

However, from April 1st, 2025, this exemption threshold will drop to £300,000 for purchases up to £500,000 and £125,000 for purchases above £500,000.

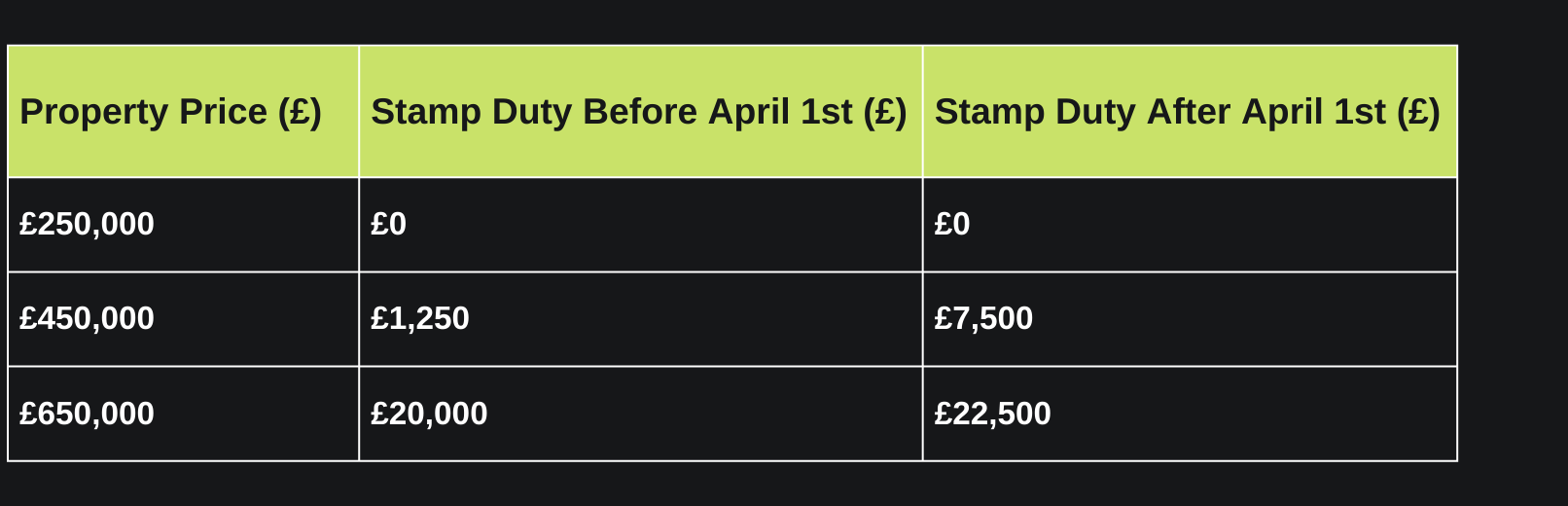

Example New Stamp Duty Rates for First-Time Buyers (From April 1st, 2025):

If the property price exceeds £500,000, you will not be eligible for first-time buyer relief. Instead, standard stamp duty rules will apply.

If you are already in the process of buying, it’s important to work closely with your solicitor to ensure completion before March 31st if you want to benefit from the current exemption.

If you haven’t yet found a property, these changes mean you’ll need to factor stamp duty costs into your home-buying budget moving forward.

Key Considerations for First-Time Buyers Ahead of the Deadline

1. If You’re Already in the Process of Buying

✔ Check with your solicitor – Ensure they are working towards completion before March 31st.

✔ Stay proactive – Delays in paperwork, mortgage approvals, or legal processing could push your completion date beyond the deadline.

✔ Understand the impact of a delay – If completion is after March 31st, you will need to budget for the higher stamp duty rates.

2. If You’re Still Searching for a Property

If you haven’t yet found a property, here’s what to consider:

✔ Adjust Your Budget – Factor in stamp duty when calculating affordability.

✔ Review Mortgage Options – A mortgage adviser can help explore the most suitable options for you.

✔ Consider Market Trends – The change in stamp duty could impact demand and pricing in certain areas.

While missing the exemption deadline means an increase in upfront costs, the post-deadline market could bring new opportunities, such as reduced competition and greater negotiating power with sellers.

FAQs

What happens if I exchange contracts before April 1st but complete after?

Stamp duty is calculated on the completion date. If completion occurs after April 1st, higher rates will apply.

Can I still save if my property costs over £425,000?

Yes, but only on the portion above £425,000 before April 1st. After this, the taxable portion is for any amount over £300,000.

What if my purchase is delayed by the Land Registry or conveyancer?

Land registry delays will not prevent you from completing as it is standard that post submission of the title registration, this can take some months. However, if there are delays with the conveyancing process, be this with your solicitor or the vendors, you could miss the required completion date of March 31st and higher rates will apply.

Planning Ahead for Your Home Purchase

While the stamp duty exemption reduction means higher costs for many first-time buyers, it’s still possible to manage your budget effectively and make informed decisions about your home purchase.

At Henry Dannell, we specialise in helping first-time buyers navigate financial challenges, find the best mortgage solutions, and plan for homeownership successfully.