Unlocking property wealth or buying a new home later in life

Lifetime mortgages allow you to release money from your home while continuing to live there. Many people use them to supplement retirement income, support family, or fund a move in later life.

This guide explains how they work, the benefits and risks, who they suit, and where they fit alongside other options.

What is a Lifetime Mortgage?

A lifetime mortgage is a loan secured on your home, which usually becomes available once you are aged 50 or older. You remain the legal owner of the property, and you can choose whether to make repayments.

- If you make no repayments, interest is added to the loan and compounds over time.

- The loan and interest are repaid when you die or move into long-term care.

Lifetime mortgages recommended by regulated advisers at Henry Dannell follow Equity Release Council standards. These products will offer key safeguards such as;

- No Negative Equity Guarantee: you will never owe more than the home’s value

- Right to Remain: you can stay in your home for life, if it remains your main residence

Benefits and Risks at a Glance

| Area | Benefits | Considerations |

|---|---|---|

| Stay in your home | Unlock cash without selling | Your home is the security for the loan |

| Cash flow | No repayments required | Interest builds up if unpaid |

| Access to funds | Lump sum, drawdown, or both | Further borrowing is subject to lender approval |

| Family support | Gift deposits or provide early inheritance | Reduces what is left to beneficiaries |

| Estate planning | May reduce inheritance tax exposure | Could affect entitlement to benefits |

| Safeguards | Equity Release Council guarantees protect you | Early repayment charges may apply |

Market Insight: Aviva (Oct 2023) found that 25% of grandparents have helped or plan to help grandchildren buy their first home, typically gifting around £31,400.

Is a Lifetime Mortgage Right for You?

Who It May Suit

Lifetime mortgages can be helpful if you:

- Want to stay in your home but unlock equity

- Have limited pension income but a considerable equity in your property

- Would like to help children or grandchildren financially

- You are comfortable with reducing your estate in exchange for liquidity now

When It May Not Fit

They may not be right if you:

- Plan to downsize soon (not all Lifetime Mortgages are portable)

- Want to maximise inheritance for your family

- Rely on means-tested state benefits

- Could meet your needs with a loan or traditional remortgage

Prefer complete repayment flexibility without charges

Eligibility in Plain Terms

- Age: 50–55+

- Property: Main UK residence

- Loan size: Based on your age, property value, and sometimes health or lifestyle

- Ownership: You can have a small mortgage, but there will need to be considerable equity

How Lifetime Mortgages Work in Practice

- Release funds: as a lump sum, drawdown, or combination

- Interest: charged on the loan, added to the balance if not paid monthly

- Ownership: you remain the legal owner, with a lender’s charge registered

- End of plan: loan plus interest repaid when you die or enter care

- Optional payments: many plans allow up to 10% annual repayments without penalty

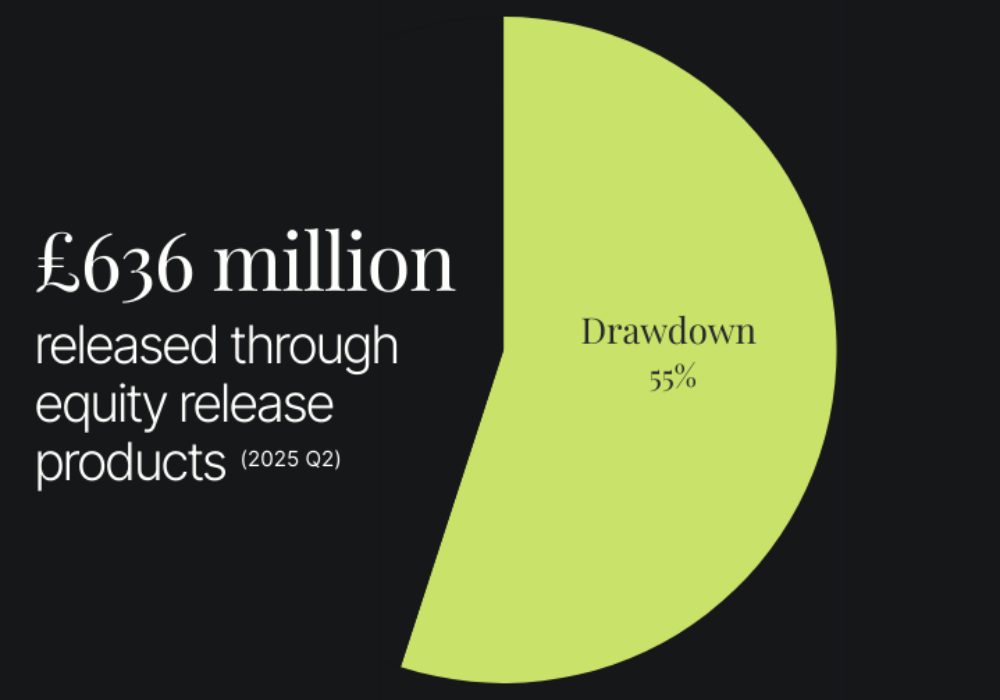

Market Insight: In Q2 2025, older homeowners released £636 million through equity release products, a 10% increase year-on-year, with 55% choosing drawdown mortgages as the preferred structure. (Source: Equity Release Council)

Real Examples of Use

Early Inheritance

A retired couple with a £1.2m home released £250,000 in stages to help grandchildren buy homes. Using a drawdown reduced the interest impact and allowed them to see their family benefit during their lifetime.

Preserving Investments

A retired business owner wanted £300,000 for lifestyle costs but avoided selling equities during a downturn. A lifetime mortgage provided liquidity, later repaid in part once markets improved.

Care and Lifestyle

A widow in her late 80s released £100,000 to adapt her home and fund live-in carers, allowing her to stay in familiar surroundings.

Market Insight: In Q1 2025, 5,620 new lifetime mortgages were arranged, worth £530 million, a 39.5% rise in value compared with the year before. (Source: MoneyWeek, Equity Release Council)

Costs, Safeguards, and Small Print

- Safeguards: No negative equity guarantee, right to remain in your home

- Fees: Advice, legal, valuation, and product fees apply

- Charges: Early repayment penalties vary by lender

- Benefits: Cash may affect entitlement to some state benefits

Key Questions Before Applying

- How much equity do I need to release, and when?

- What impact will this have on my family and estate?

- Would downsizing be a simpler or cheaper solution?

- Can I afford voluntary repayments to reduce the long-term cost?

- If I move, can I transfer the plan to a new property?

FAQs

Is a lifetime mortgage the same as equity release?

Yes. A lifetime mortgage is the most common form of equity release in the UK.

Can I pay it off early?

Some plans allow voluntary repayments, but many include early repayment charges. Terms vary by lender.

Do I still own my home?

Yes. You remain the legal owner. The lender registers a charge against the property.

Can it reduce inheritance tax?

Potentially. By reducing your estate value, equity released can lower IHT exposure, but tailored advice is essential.

Next Steps

Specialist advice is crucial. An adviser can:

- Confirm your eligibility and borrowing limits

- Compare product types and lender terms

- Explain costs and safeguards in detail

- Review implications for inheritance, tax, and benefits

With expert guidance, you can unlock property wealth with confidence and decide whether a lifetime mortgage is the right fit for your plans.

Speak to a Henry Dannell Lifetime Mortgage Specialist for tailored advice.