What is Whole of Life Insurance?

Whole of Life insurance, also known as lifetime cover, is a type of life insurance policy that guarantees a payout whenever you die, as long as you keep up with the premiums.

Unlike term life insurance, which only covers you for a fixed number of years, whole of life insurance is permanent, making it a popular choice for long-term financial planning, including inheritance tax (IHT) mitigation, funeral expenses, and legacy planning.

How Does Whole of Life Insurance Work?

- You choose a level of cover (e.g. £250,000).

- You pay regular premiums, monthly or annually, for life.

- When you die, the policy pays out a lump sum to your nominated beneficiary or trust.

- The payout is guaranteed, regardless of when you pass away.

Who Should Consider Whole of Life Cover?

Whole of life insurance is best suited for people who:

- Want to provide a guaranteed inheritance for loved ones.

- Are planning for inheritance tax liabilities.

- Have significant assets and want to preserve wealth across generations.

- Want to ensure funeral costs or debts are covered without burdening family.

- May be supporting a dependent with lifelong care needs.

Using Whole of Life Insurance for Inheritance Tax Planning

One of the most common uses of whole of life cover in the UK is to cover expected inheritance tax.

Inheritance tax (IHT) is typically charged at 40% on estates exceeding the nil-rate band (£325,000 in 2025, or potentially more with allowances). If you anticipate a tax liability, a whole of life policy can provide the funds needed to pay HMRC, without forcing your heirs to sell assets like property or investments.

Tip: To avoid increasing your estate further, write the policy in trust. This ensures the payout is made outside your estate and directly to beneficiaries or to cover IHT.

Types of Whole of Life Insurance

There are two main types of cover in the UK:

1. Guaranteed Whole of Life Insurance

- Fixed premiums and guaranteed payout

- No investment risk

- Predictable and stable, but typically more expensive

2. Investment-Linked Whole of Life Insurance

- Premiums and benefits may vary based on performance of underlying investments

- Offers potential for value growth

- More flexible, but carries some risk

For estate planning and IHT cover, guaranteed policies are often preferred due to their predictability.

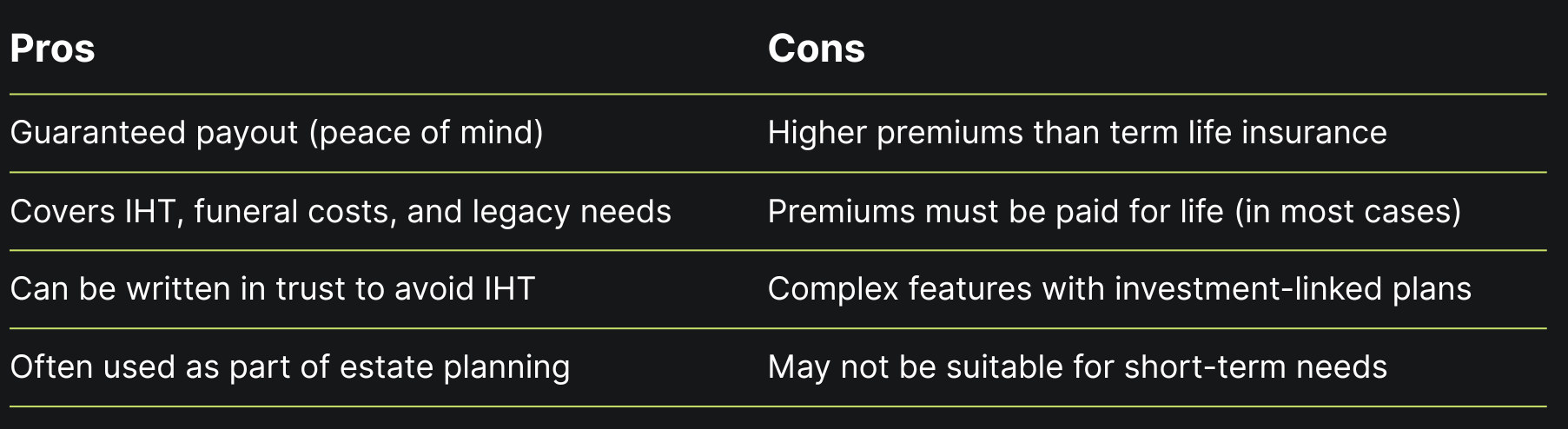

Pros and Cons of Whole of Life Insurance

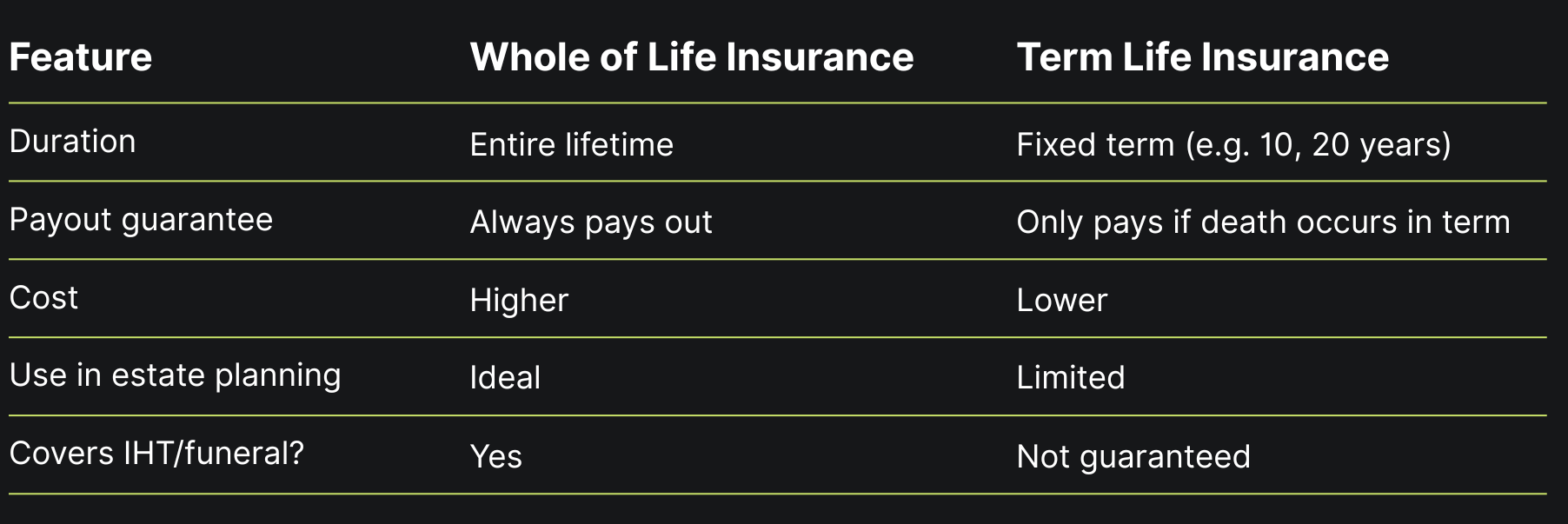

Whole of Life vs Term Life Insurance

How Much Does It Cost?

Premiums vary based on:

- Your age at application

- Health and lifestyle

- The amount of cover

- Whether you choose guaranteed or investment-linked options

- Smoker status and medical history

For example, a healthy non-smoker aged 50 might pay £80–£150/month for £100,000 in guaranteed cover. Underwriting is common, and quotes are personalised.

How to Structure Whole of Life Insurance

Single or Joint Life

- Single life: covers one person

- Joint life: often second death basis, useful for couples planning IHT cover

Written in Trust

- Keeps payout outside your estate

- Speeds up access to funds

- Avoids additional IHT on the policy itself

Level or Indexed Cover

- Level cover: fixed payout

- Indexed: increases annually to keep pace with inflation

Is Whole of Life Insurance Right for You?

Consider it if you:

- Have an estate that exceeds IHT thresholds

- Want to leave a tax-free inheritance

- Don’t want loved ones to sell property or assets to pay tax

- Value long-term financial planning over short-term affordability

It may not be ideal if you’re simply looking for low-cost protection for short-term needs, term insurance may be more appropriate in those cases.

Summary: Key Facts About Whole of Life Insurance

- Covers you for your entire life – guaranteed payout

- Commonly used to cover inheritance tax

- Premiums are typically higher but offer certainty

- Can be written in trust to improve tax efficiency

- Offers long-term peace of mind for families

Whole of Life Insurance isn’t just about covering costs, it’s about creating certainty. Whether you’re planning to mitigate inheritance tax, protect your family from financial burden, or ensure your legacy passes smoothly to the next generation, this form of cover can play a pivotal role in your estate planning strategy. As with any long-term decision, expert guidance is essential. Speak with an adviser to explore the right structure, provider, and approach tailored to your goals.

Learn more about other solutions to mitigate inheritance tax

Please note: The information provided in this article is for general informational purposes only and does not constitute financial or tax advice. Henry Dannell Private Clients Limited does not offer tax advice. We recommend consulting with a qualified tax adviser or financial planner to assess your individual circumstances. While we strive to ensure the accuracy of the information presented, we cannot guarantee its applicability to your specific situation.