What the May 2025 Interest Rate Cut Means for Your Mortgage

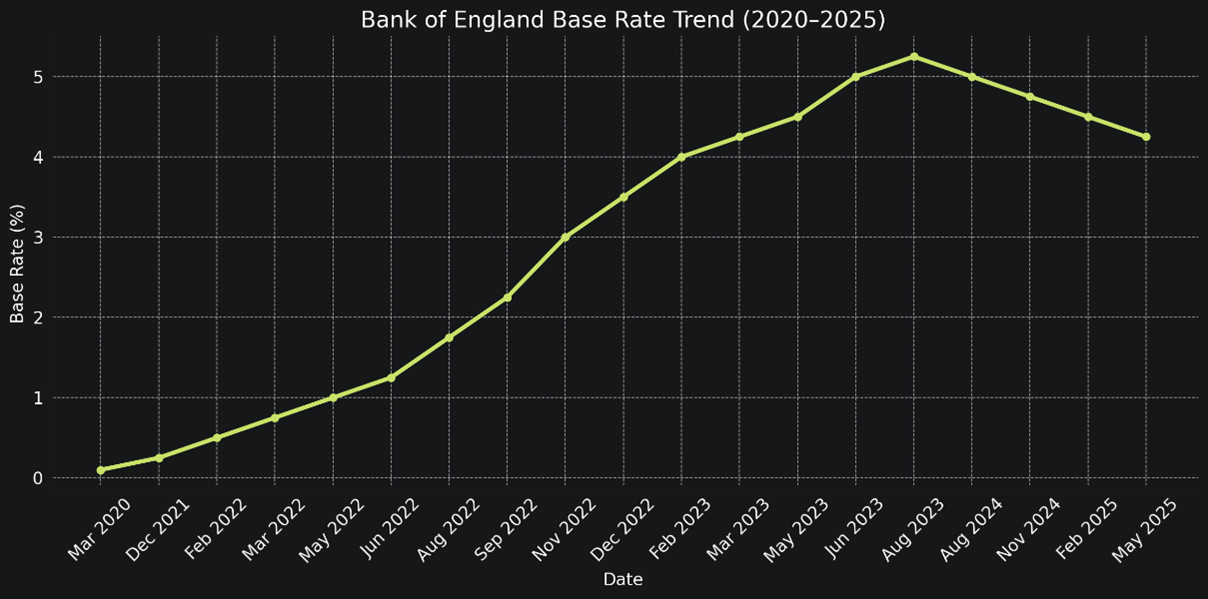

The Bank of England’s Monetary Policy Committee (MPC) has cut the base rate by 0.25%, bringing it down to 4.25%. This decision marks a significant shift in the UK’s economic outlook and directly impacts mortgage prospects.

Whether you’re a homeowner, buy-to-let investor, or first-time buyer, understanding how this decision influences mortgage rates is key to making informed financial choices in the months ahead.

What’s behind the May 2025 interest rate cut?

After two years of aggressive interest rate hikes aimed at controlling inflation, the tide has turned. Inflation has eased to within range of the Bank’s 2% target, providing the required market stability needed by the BoE to reduce rates.

In essence, the cut is designed to stimulate growth, and one of the most immediate levers is mortgage affordability.

Data sourced from the Bank of England’s official records

How does the May 2025 rate cut affect your mortgage?

If you’re on a tracker, you’ll see a direct benefit almost immediately. Most tracker mortgages follow the base rate plus a fixed margin, so your monthly repayments should fall within the next month. Typically, for the discount variable rates, it can take around a month to see the benefit, as these are most commonly offered by smaller building societies that have a process to change their internal variable rate.

If you’re on a fixed rate, while your current rate remains unchanged, this decision could improve your refinancing options. In anticipation of this rate change, many lenders have already been reducing rates over the past few weeks.

Considering a new purchase or remortgage?

This is a window of opportunity. While lenders are often slower to pass on reductions than increases, competition is intensifying. Banks and specialist lenders are expanding their product ranges to have a wider product offering.

A wider look at the economy

This decision is part of a broader global shift. Central banks in Europe and the US are signalling similar intentions, creating a more supportive environment for lending. In the UK, the move is also politically relevant, designed to ease pressure on households and stimulate cautious optimism.

At the same time, economic risks persist. The cost of living remains high, and lenders continue to apply rigorous affordability checks. While this rate cut will help, the business investment is still weak, new tariffs from the US may hurt trade, and household budgets remain tight. That’s why it’s more important than ever to seek personalised advice when considering your next steps.

Require expert advice?

Navigating the evolving mortgage landscape requires informed decision-making. Our team at Henry Dannell is here to provide personalised guidance tailored to your individual needs and discuss how this rate cut may affect your mortgage and explore the best options available to you.