What is a Gift Inter Vivos Insurance Policy?

A Gift Inter Vivos insurance policy is a specialist type of life insurance designed to cover the potential inheritance tax (IHT) liability that can arise when a person makes a large gift during their lifetime.

Under UK tax rules, gifts made during one’s lifetime may still be subject to IHT if the person giving the gift (the donor) dies within seven years. This policy helps protect the recipient(s) of the gift by ensuring the tax bill doesn’t fall on them unexpectedly.

Why Would You Need One?

When someone makes a significant gift, such as a large sum of money, shares, or property, they may assume it’s exempt from inheritance tax. While this can be true, the exemption only becomes permanent if the donor survives for seven years.

If the donor passes away sooner, the gift becomes a Potentially Exempt Transfer (PET) and may attract IHT. That liability is usually the responsibility of the recipient, not the estate.

A Gift Inter Vivos policy provides insurance cover for this seven-year risk window, offering peace of mind to both parties.

How Does a Gift Inter Vivos Policy Work?

- The policy is taken out on the donor’s life.

- It typically runs for seven years, aligning with HMRC’s IHT exemption timeline.

- The level of cover decreases each year, in line with taper relief (the way tax liability reduces over time).

- If the donor dies within the term, the policy pays out a lump sum to cover the IHT due on the gift.

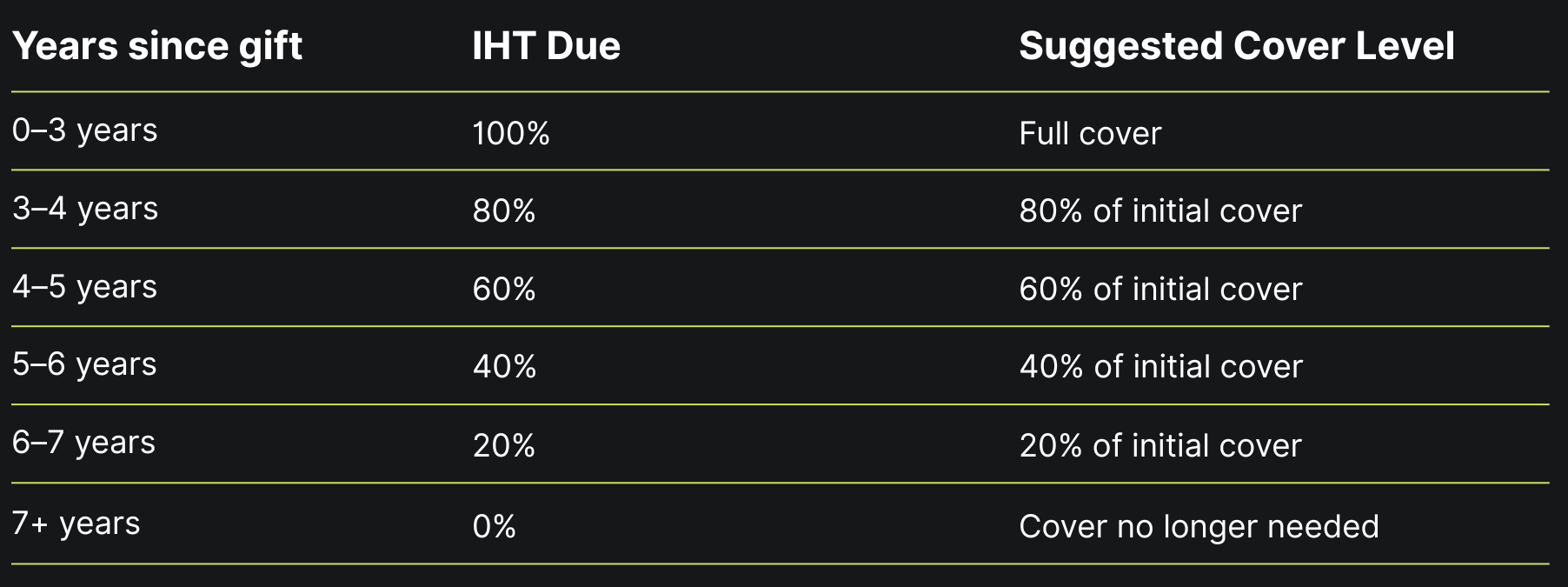

Understanding Taper Relief and Tax Liability

If the donor dies within three years of making the gift, full IHT may be payable. Between years 3–7, taper relief reduces the liability.

The policy mirrors this schedule, reducing the insured amount over time.

Who Typically Buys a Gift Inter Vivos Policy?

This type of policy is usually considered when:

- A large gift is being made (above the nil-rate band of £325,000).

- The recipient would not be able to comfortably pay any potential IHT.

- The donor is using lifetime gifting as a tool for estate planning.

- There is a desire to avoid disruption to the recipient’s finances, such as needing to sell assets to pay tax.

Example Scenario

Emma gifts her son £500,000 to help him purchase a home. If she dies within three years, and her total estate (including the gift) exceeds the nil-rate band, an inheritance tax bill of up to £70,000 (40% of £175,000) could arise.

By taking out a Gift Inter Vivos policy with a seven-year decreasing term, Emma ensures that if she dies during that period, the policy would cover the tax payable, protecting her son from a sudden liability.

Concessionary Purchase with Gift Inter Vivos policy

A concessionary purchase, where a property is bought at below market value, often from a family member, can work hand in hand with a Gift Inter Vivos policy to provide a comprehensive estate planning solution. In such cases, the discount on the purchase price is treated as a gift for Inheritance Tax (IHT) purposes and could be liable for tax if the seller passes away within seven years.

A Gift Inter Vivos policy is designed to cover the potential IHT liability that reduces over time, mirroring the seven-year taper relief period. By putting a Gift Inter Vivos policy in place alongside the concessionary purchase, the recipient can protect themselves against any unexpected tax charges, ensuring that the full benefit of the discounted acquisition is preserved without burdening the estate or beneficiaries later.

Learn more about concessionary purchases

How Much Does It Cost?

Premiums depend on several factors:

- The donor’s age and health at the time of application

- The value of the gift

- The term length (typically 7 years)

- Whether single or joint life cover is needed

- Whether the policy includes any additional underwriting

Younger, healthier individuals can typically expect lower premiums.

Policy Features and Options

- Decreasing term cover – tailored to match taper relief

- Single life basis – covers the donor only

- Written in trust – to ensure quick payout and avoid adding to the estate

- No payout if donor survives 7 years – no claim, as the gift becomes tax-free

- Optional add-ons – some providers may offer riders like terminal illness benefit

Important Considerations

Trust Arrangement:

It’s standard practice to write the policy in trust, so that the payout does not form part of the estate and delay probate.

Premiums are non-refundable:

If the donor survives the full term, the policy ends with no payout.

Medical Underwriting May Be Required:

Especially for older individuals or high-value gifts.

Can be layered with other planning tools:

Such as lifetime trusts, gifting strategies, and whole-of-life insurance.

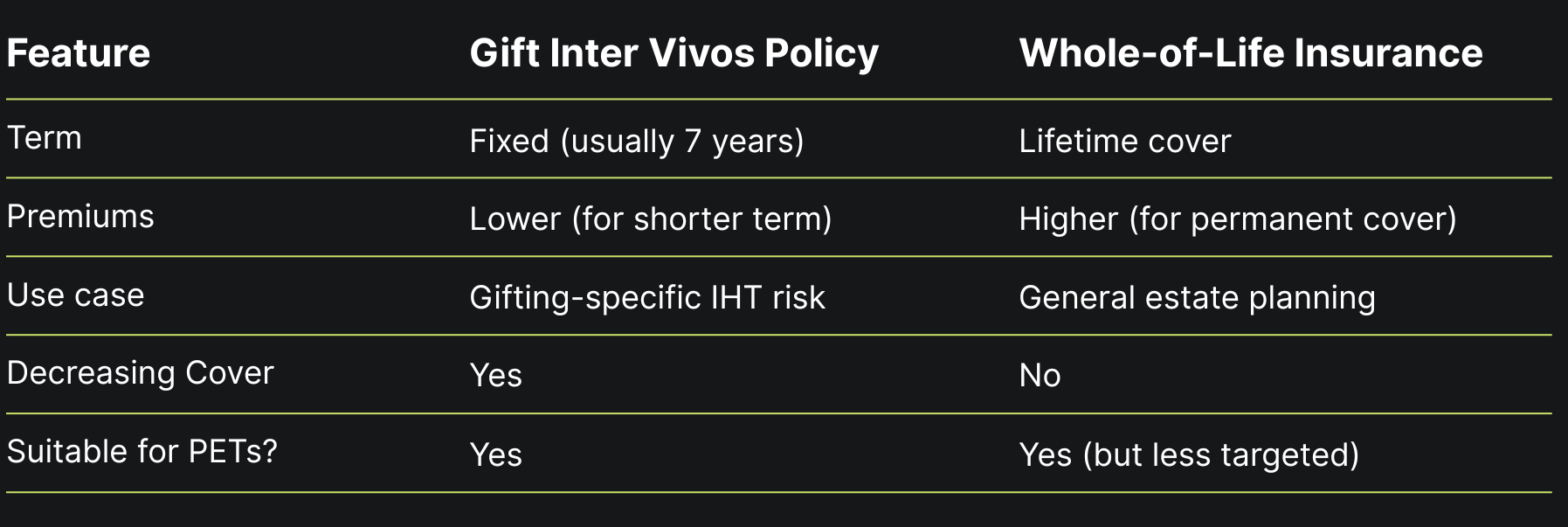

Gift Inter Vivos Insurance vs Whole-of-Life Cover

A Gift Inter Vivos insurance policy is a useful and often underutilised tool in estate planning. It offers a targeted solution to a very specific inheritance tax risk, providing financial protection for those receiving significant gifts.

While it won’t eliminate the need for careful tax planning, it offers peace of mind and ensures your generosity doesn’t inadvertently create a burden.

Learn more about whole of life cover

Frequently Asked Questions

1. Can I take out the policy after giving the gift?

Yes, but ideally it should be arranged at the time of gifting to ensure continuous cover for the seven-year period.

2. Who pays the premiums?

Usually the donor, but the recipient can pay if agreed, especially since they are the party most affected by potential IHT.

3. What happens if I make multiple gifts?

You can take out multiple policies or use a single policy if the timing and structure of the gifts allow for a consolidated approach.

While often overlooked, a Gift Inter Vivos insurance policy is a valuable way to safeguard the impact of your generosity. Whether you’re gifting to help family onto the property ladder or pass on wealth early, this policy can prevent financial strain on loved ones should the unexpected occur. As with any estate planning strategy, it’s worth discussing your options with an adviser to ensure your approach aligns with your broader financial goals.

Please note: This article is intended for informational purposes only and does not constitute financial or tax advice. Henry Dannell Private Clients Limited does not provide tax advice. We advise consulting with a qualified tax adviser or financial planner to understand how Gift Inter Vivos Insurance may apply to your personal circumstances. The information provided is based on current regulations, which are subject to change.