June 2025 Base Rate Held at 4.25%: What Borrowers Need to Know

The Bank of England (BoE) has voted to hold the base rate at 4.25%, following the 0.25% cut in May. While widely anticipated, this decision reflects a period of consolidation, balancing cautious optimism with the realities of stubborn inflation and ongoing global uncertainty.

For borrowers, it provides a clear message: if looking to remortgage, now is the time to secure a rate as a security measure. If you are considering a purchase, this signals further market stability, making it a compelling time to take the next step.

What Was Behind the Decision to Hold the Base Rate in June 2025?

Despite strong expectations for further rate cuts this year, the MPC chose to pause in response to a slight uptick in inflation and continued global economic uncertainty. Although inflation remains above the Bank’s 2% target, the overall trend is downward. Holding the rate provides a more stable foundation for the market and avoids moving prematurely.

What Are Lenders Doing?

- Fixed Rate Volatility: Several high street lenders have raised rates in recent weeks due to revised expectations around future cuts. Others have reduced pricing, highlighting the importance of active monitoring.

- Product Innovation: From higher LTVs to niche fixed terms, many lenders are broadening their offerings in response to stabilised funding costs.

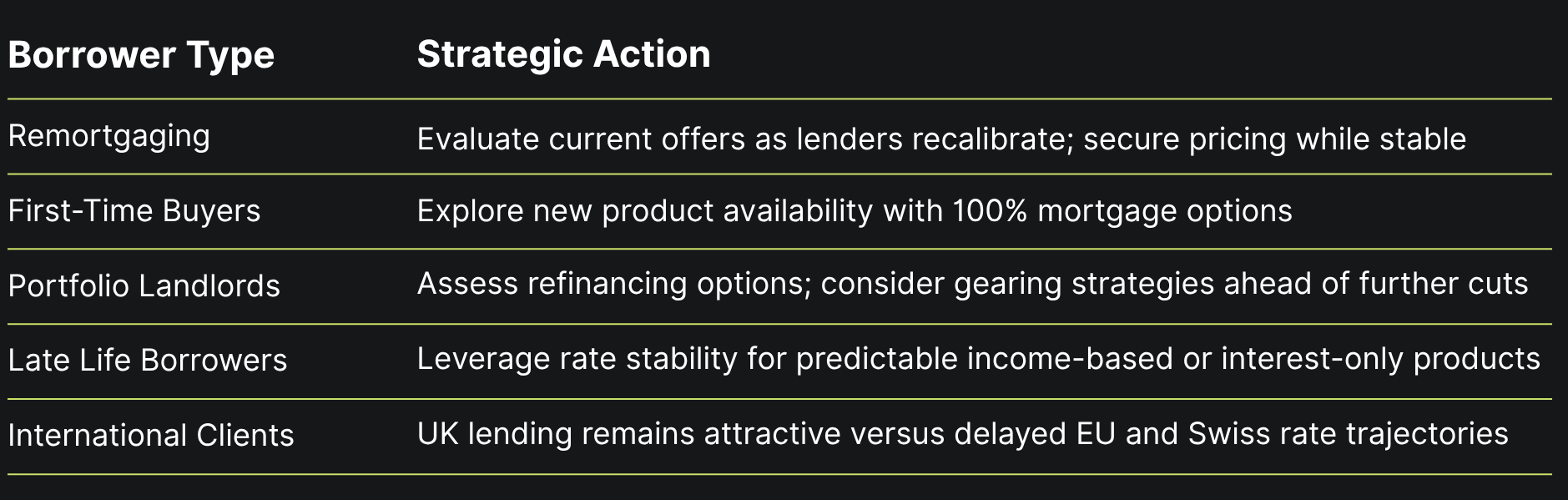

Key Considerations for Borrowers

Broader Economic Context

This hold is part of a carefully phased approach by the BoE. While other central banks have begun cutting more aggressively, the Bank of England is prioritising a controlled return to lower rates, balancing inflation risk with economic stability.

However, several risks remain:

- Energy costs and geopolitical events are pushing inflation in the short term.

- Real wage growth remains inconsistent across sectors.

- US-EU trade policy shifts are influencing global lending sentiment.

Forecasts continue to suggest two or three more cuts by the end of 2025, potentially bringing the base rate down to 3.75%. For borrowers, this represents a key window to plan ahead.

Although this decision should not be taken lightly, there is no harm and often no cost in securing a rate now and then re-evaluating the market throughout the process before completion. This offers the best of both worlds: you lock in a rate as a safeguard but retain the flexibility to benefit from reductions should they materialise before completion.

Require expert advice?

Navigating the evolving mortgage landscape requires informed decision-making. Our team at Henry Dannell is here to provide personalised guidance tailored to your individual needs and discuss how this rate cut may affect your mortgage and explore the best options available to you.