What is a Potentially Exempt Transfer (PET)?

A Potentially Exempt Transfer (PET) is a gift made during your lifetime that may become exempt from Inheritance Tax (IHT), if you survive for seven years after making the gift.

This is a key part of UK inheritance tax planning. By making gifts to individuals during your lifetime, you may reduce the size of your estate and the amount of tax due when you pass away.

However, if you die within seven years of making the gift, some or all of its value may still be counted towards your taxable estate, triggering IHT. That’s where the “potentially” part comes in.

How PETs Work

- A PET is usually a gift to an individual (not to a trust or company).

- You must fully give away the asset with no ongoing benefit or control.

- The PET starts the seven-year clock for IHT exemption.

- If you survive seven years, the gift becomes fully exempt from IHT.

- If you die within seven years, the PET becomes a chargeable transfer, and may be subject to IHT.

The 7-Year Rule and Inheritance Tax

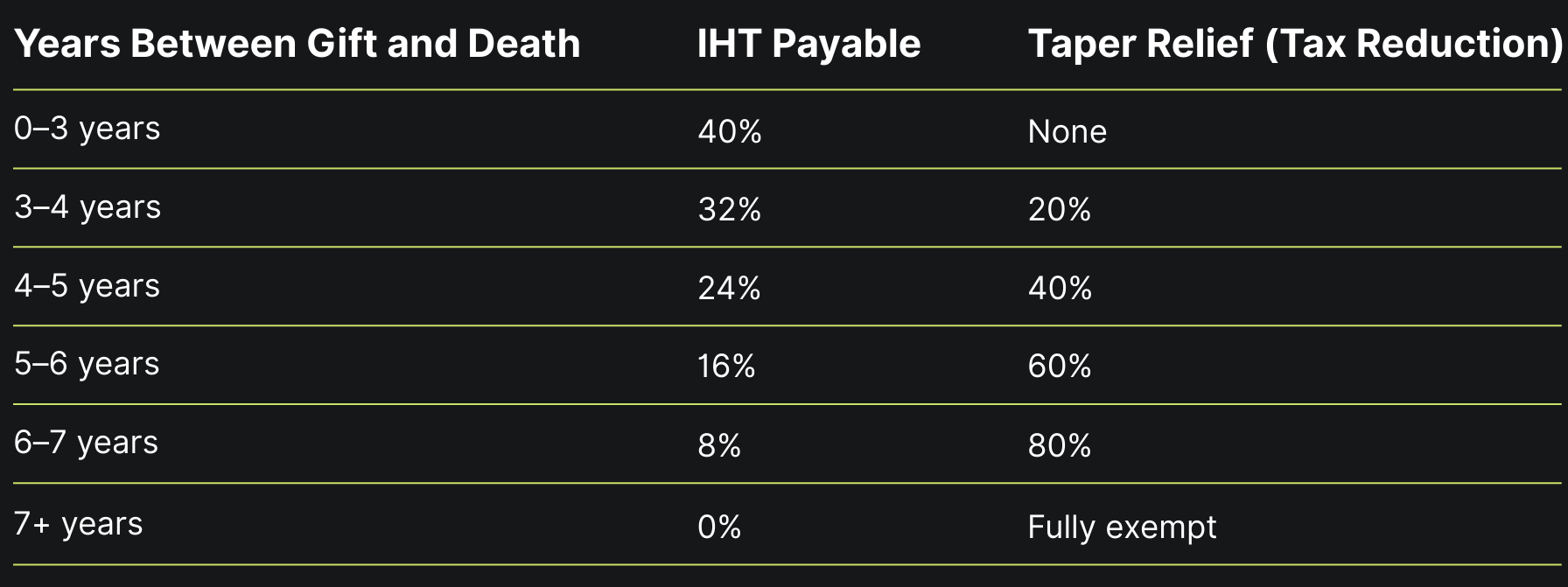

PETs are most powerful when used in line with the seven-year rule. Here’s how it works for gifts exceeding the nil rate band:

Important: Taper relief applies to the tax due, not to the value of the gift. Also, the full value of the gift counts toward your nil-rate band (currently £325,000).

Who Can You Gift To?

PETs are typically made to:

- Family members (e.g., children or grandchildren)

- Friends

- Anyone not receiving the gift into a trust or company

Gifts into most trusts or companies are not PETs, they are Chargeable Lifetime Transfers (CLTs) and may have immediate tax consequences.

Examples of PETs

Cash Gifts to Children

You give your daughter £100,000 to help buy a home. You live more than 7 years after the gift, so no IHT is due.

Gift of a Second Property

You gift your son a buy-to-let property worth £250,000. You die 5 years later. The gift is subject to taper relief and counts against your nil-rate band.

Gift into a Trust

Not a PET. This would be a Chargeable Lifetime Transfer and could trigger immediate IHT above thresholds.

Exemptions and Allowances That Work Alongside PETs

Some gifts are exempt from IHT immediately, regardless of whether you survive 7 years:

- Annual exemption: Up to £3,000 per tax year

- Small gifts exemption: Up to £250 per person

- Wedding gifts: Up to £5,000 depending on the relationship

- Regular gifts from surplus income: If you can prove they don’t affect your standard of living

These do not count as PETs, because they are automatically exempt.

Common PET Mistakes to Avoid

- Continuing to benefit from the gift

If you gift your house but continue living in it rent-free, HMRC may treat it as a gift with reservation of benefit, making it still part of your estate. - Not keeping clear records

Always document the amount, recipient, date, and purpose of the gift in case of future IHT review. - Gifting into the wrong vehicle

Gifts into most trusts and companies aren’t PETs; double-check the structure to avoid unexpected charges.

What Happens If You Die Within 7 Years of Making a PET?

If you pass away within 7 years:

- The gift is added back to your estate.

- IHT may be payable by the recipient (unless specified otherwise).

- Taper relief may reduce the amount due if the gift was made 3+ years before death.

Many people use a Gift Inter Vivos insurance policy, a decreasing term insurance plan designed to cover the IHT liability, to protect recipients from a potential tax bill.

Learn more: What is a Gift Inter Vivos Policy →

How PETs Fit into Estate Planning

PETs are a cornerstone of effective inheritance tax mitigation when used properly. Key benefits include:

- Reducing the size of your taxable estate

- Helping loved ones when they need it most

- Taking advantage of lifetime tax planning opportunities

- Avoiding or reducing future IHT bills with strategic timing

Summary: Key Facts About PETs

- PETs are lifetime gifts to individuals that become IHT-free after 7 years.

- They are not taxed at the time of the gift, but may become chargeable if the donor dies within 7 years.

- Taper relief may reduce the tax due based on time elapsed.

- Record-keeping and planning are essential to avoid issues.

- May be combined with insurance to mitigate risk.

Potentially Exempt Transfers offer a powerful way to reduce inheritance tax and support loved ones during your lifetime, but only if used wisely. With the right planning, PETs allow you to pass on wealth effectively, take advantage of tax rules, and ensure your legacy is protected. As with any estate planning strategy, it’s worth seeking professional guidance to ensure your gifts are structured in a way that delivers long-term benefit and peace of mind.

Please note: The content of this article is for general information purposes only and does not constitute financial or tax advice. Henry Dannell Private Clients Limited does not offer tax advice. Individuals should seek advice from a qualified tax adviser or financial planner to understand how Potentially Exempt Transfers (PETs) may affect their personal financial situation. Tax laws and regulations are subject to change, and the information provided may not reflect the most current legal developments.