What is Bridging Finance?

Often referred to as a ‘bridging loan’, bridging finance is a short-term solution that works to access immediate funds that ‘bridge the gap’ while seeking a long-term funding solution or asset disposal. When bridging, you can usually access a term that lasts from a few weeks to as long as 12 to 18 months. It is designed to enable the completion of time-sensitive transactions until a permanent solution, such as a mortgage, is in place.

Bridging Loan vs Mortgage: What Is The Difference?

Bridging loans offer a solution for quick, short-term needs, making them ideal when you need fast finance that can be closed within 12 months (in some instances, longer). While mortgages are a long-term agreement, either for the ownership of your home or a wider asset position for the long term.

Both lending options have a unique set of features. Here are the clear differences to consider when selecting a mortgage or bridging loan.

| Bridging Loan | Mortgage |

|---|---|

| Short-Term: 1–18 months | Long-Term: Often 5–40 years |

| Quick, short-term borrowing to bridge a gap | Long-term borrowing to buy or keep a home |

| Fast (days–weeks) | Slower (weeks–months) |

| Can be for properties that need work or do not meet mortgage lending criteria | In most cases must be ready to live in or rent out |

| Higher and often charged monthly | Lower and charged annually |

| Monthly or rolled-up interest | Monthly installments |

| Requires an exit strategy | Not required |

According to Bridging Trends, a bridging loan required a 32-day average completion time in 2025 Q1, compared with 39 days in 2024 Q4.

What Are The Benefits of a Bridging Loan?

Bridging loans come with important considerations, such as rolled-up interest repayments and the requirement for an exit strategy. However, the advantages of a bridging loan are unique to your circumstances.

In the scenario of property purchase, the clearest advantage is that you can purchase a new property while waiting for a buyer of your current home. This positions you as the most advantageous buyer, as you can proceed quickly without a chain. In other cases, advantages often focus on maximising access to time-sensitive opportunities.

Regulated Or Unregulated Bridging Loans

What Is A Regulated Bridging Loan?

Bridging Loans Protected By FCA Regulation

Regulated bridging loans are FCA-regulated and used when the property is a primary residence for you or a close relative. Typically, homeowners will use this type of loan when they wish to buy a new home before selling the current one. This can avoid a broken chain.

What Is An Unregulated Bridging Loan?

Bridging Loans Not Protected By FCA Regulation

Unregulated bridging loans are typically for business-related or investment purchases, not covered by FCA rules. Another example of a scenario that would be considered unregulated is a landlord buying and flipping a property, without any plans to occupy it as their residence.

Here is a quick comparison table to help you identify which type of bridging finance would be most appropriate for your lending requirements:

| Feature | Regulated Bridging Loan | Unregulated Bridging Loan |

|---|---|---|

| Regulation | Regulated by the Financial Conduct Authority (FCA) | Not regulated by the Financial Conduct Authority (FCA) |

| Use Case | Purchasing or refinancing a property intended or previously used as a primary residence for the borrower or a close relative | Investment, commercial use, or buy-to-let purposes |

| Documentation Required | Extensive includes income, expenditure, ID, credit checks and a detailed exit plan. | Lighter, often focused on asset and exit strategy |

| Exit Strategy | Scrutinised in detail due to regulatory oversight | Must still be viable but less rigorously assessed |

| Speed of Completion | Typically slower due to regulatory checks | Often faster due to streamlined process |

| Interest Rates & Fees | Often higher due to a reduced lender pool | Often more competitive but can vary based on risk |

| Examples of Use | Bridging a gap in a residential chain, downsizing | Auction purchases, development finance, property flipping |

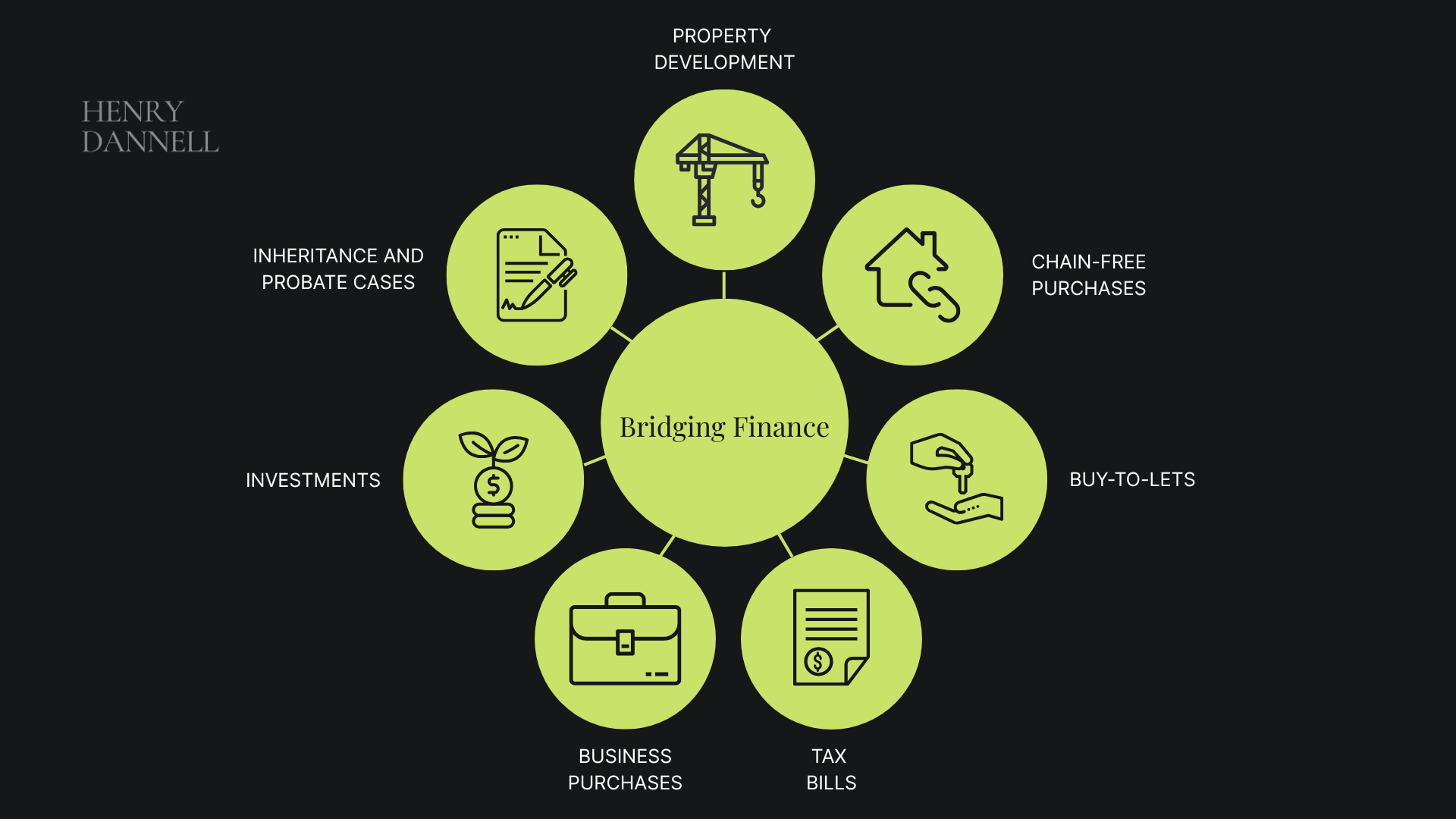

What Can Bridging Finance Be Used For?

Although many clients use a bridging loan for property purchase to buy before selling, there are many other use cases when bridging loans become appropriate.

Common Use Cases For Bridging Loans

Bridging offers versatility. It offers support for residential, commercial, and investment opportunities. With its primary advantage being speed and flexibility, many lenders market bridging loans as a great option for scenarios such as auction purchases, funding renovation work, or resolving a chain break. Here are some of the most common use cases in 2025 Q1:

Source: Data from Bridging Trends (5th June 2025)

Bridging Loans for Property Purchase

A bridging loan provides capital fast. When purchasing a property, many will opt for this finance when their preferred route is too slow. One first-time landlord secured a £204,375 Bridging Loan to purchase a property when he saw an opportunity in a BTL property at auction, when the requirement to act quickly is key.

Bridging Finance for Auction Property Purchases

Auctions typically have tight completion deadlines, during which funds must be secured, usually within 28 days. Traditional mortgages are usually not ready within this time frame. Therefore, the bridging loan acts as a temporary source of funds, then most will refinance the loan using a standard mortgage once it becomes available at a later stage. This is a common exit strategy.

Bridging Loans for Refurbishment

Bridging loans also enable access to the required funds for a refurbishment, where mortgage lenders may not initially offer a standard mortgage due to the property’s current state. In this case, you may use bridging finance to carry out renovation work on a house before exiting the short-term bridging loan with a mortgage, once the property meets standard mortgage requirements.

Bridging Loans for Chain Break

Bridging loans can also rescue your house purchase when a sale falls through. If your buyer were to pull out, you could still proceed to complete the buying process by keeping your onward purchase intact. A bridging loan acts as a replacement for the funds until you find a new buyer.

Bridging Loans for Downsizing

Homeowners in later life may reach a point where their lifestyle requires a smaller property, but moving on from what was once their ‘forever home’ feels like a big step. Bridging loans provides breathing space to make the transition without selling a property, full of memories, until they feel settled in a new chapter. With a bridging loan in place, the family can take a slower pace throughout the emotional and practical process of selling the family home.

Commercial Bridging Loans

A commercial bridging loan enables investors to purchase or refinance commercial premises, such as office spaces, retail units, or mixed-use buildings, at pace. This type of use is also a clear example of when an unregulated bridging loan is more appropriate.

Development Bridging

Many developers use a bridging loan to fund their short-term projects. For example, building a conversion, carrying out renovation work, or initiating a ground-up build. One example of this is a client who turned to Henry Dannell when they required support from an advisor who could source a bridging loan to rescue a stalled development.

Bridging Loans For Self-Builds

Bridging loans become valuable to self-builders during the initial phase of their construction. Funding land acquisitions or costs during the early stages of a self-build allows borrowers to commence their projects while an advisor arranges their specialist self-build mortgage solution.

Who Uses Bridging Loans in the UK?

Bridging finance is used by a range of borrowers who are looking to solve short-term challenges and act on time-sensitive opportunities. The ‘Bridging Finance User Profiles’ diagram draws focus to six of the most common user profiles who are using bridging loans in the UK.

Source: Data from Bridging Trends (5th June 2025)

How Does Affordability Work for a Bridging Loan?

Bridging loans do not follow the same affordability checks as traditional mortgages. When considering the affordability of a bridging loan, lenders will focus mainly on two key factors.

The Value Of The Property

The value of your property offers lenders security. A lower loan-to-value (LTV) gives a stronger application as it reduces risk. This will be calculated by obtaining the market value of your property.

Typically, lenders will offer up to 75% LTV. Henry Dannell has reported cases where LTV is higher when taking into consideration additional assets or guarantees.

The market value will often be evidenced by a recent RICS valuation to support the application. It is important to note that to qualify for a bridging loan, the property is saleable and insurable. However, it is becoming more and more common for automated valuation using available property data to be used to determine the property valuation

The Credibility Of Your Exit Strategy

A lender will require you to present a plan for your exit strategy. This must be clear, achievable, and well-documented.

What are acceptable bridging loan exit strategies?

Some examples of acceptable exit strategies include:

- Existing Property Sale

- Refinancing

- A Liquidity event

To consider your exit strategy as achievable, ask yourself the following:

- Is the sales timeline realistic?

- Are there legal or market barriers that could prevent a sale?

- If you are refinancing, is this route approved in principle by the lender?

This will be in the form of an AIP or decision in principle (DIP) to evidence this.

With a strong exit plan, a lender is given reassurance that your loan will be repaid, and more importantly, on time and without risk, which, as a result, may give you access to better rates or terms.

FAQ: Can I refinance a bridging loan with a mortgage?

Yes. Refinancing a bridging loan with a mortgage is a common exit strategy. Many borrowers are using bridging finance to develop a property and refurbish it to a standard that meets mortgage lending criteria. When you meet lending requirements, you may use the mortgage to restructure your debt.

How Does Interest Work With a Bridging Loan?

The interest on a bridging loan is typically quoted with a monthly rate. It will be calculated for a 12-month term. Although you will instead pay interest for the actual duration that your facility is in place. For example, if your exit occurs at 3 months, you will only be liable for 3 months’ worth of interest, not the full term.

Interest will be structured in one of three ways:

1. Rolled Up Interest – This is paid at the end of your term.

2. Retained Interest – Where the total cost of interest will be deducted from your loan.

3. Serviced Interest – You will pay interest every month.

Example Bridging Loan Terms

What could terms look like?

Henry Dannell’s client, who was purchasing a property at £775,000.00 and selling at £3,200,000.00, needed to complete as soon as possible.

Below are the terms that were arranged:

| Detail | Amount |

|---|---|

| Net Loan | £815,034.96 |

| Gross Loan (net loan including fees) | £825,800.00 |

| Interest Rate (rolled up) | 0.55% per month (rolled up) |

| Completion Fee | £8,176.24 (1.00%) |

| Administration & Legal Fees | £2,588.80 |

| Interest over 12 months | £56,340.66 |

| Total Gross Facility (end of term) | £882,140.66 |

| Exit Fee | £0.00 |

| Property Value | £3,200,000.00 |

For complete transparency of costs, we have factored in Stamp Duty and other associated costs.

A Step-By-Step Guide To Apply For A Bridging Loan

1. Speak to an advisor about your objectives, the security, and property value. They should be able to help you with presenting an exit strategy that meets the lender’s appetite.

2. Prepare the key documents that you need to make your application for a bridging loan.

3. Once the lenders have your application, they will arrange a property valuation and review your case.

4. When terms have been agreed and once the legal process is complete, funds will be released. This is usually within a matter of days.

Do I Need An Advisor For A Bridging Loan?

It is not a mandatory requirement. You can apply directly to a lender. But there are benefits to using an advisor. Working with experts who understand how to position your application can lead to a higher success rate. There are several other key benefits.

What Is The Benefit Of Using An Advisor For A Bridging Loan?

When you apply for a bridging loan via an advisor, you gain access to whole-of-market lenders. This means wider product offerings, some of which will not be directly available.

Advisors understand how to present your unique circumstances and financial backgrounds in a way that is favourable to lenders.

You unlock access to support with the valuations, legal considerations, and exit planning. Therefore, you have less to worry about during the application process, which is beneficial during time-sensitive transactions.

Because mortgage advisors are working with applications every day and building a rapport with underwriters, you may benefit from faster turnaround. Your advisor may even negotiate more favourable terms for you.

When taking out a bridging loan, expert guidance is essential, particularly if you require a quick solution.

At Henry Dannell, we specialise in finding customised solutions to fit your objectives and requirements. With our in-depth market knowledge and access to whole-of-market lenders, we can support you in finding the most favourable rates and streamline the complex application process.

Please note: a bridging loan is a short-term loan secured against your home or property. Your home or property may be repossessed if you do not keep up repayments on your mortgage or any debt secured on it. The Financial Conduct Authority does not regulate some forms of bridging finance. Bridging finance/loan deals may not be available, and lending is subject to individual circumstances and status.